External validation confirms Included Health Navigation offering can lower healthcare cost trend by 6-10 percentage points for employers

Introduction

At Included Health, we are committed to outcomes, which requires accurately measuring and reporting on the impact our offerings have on employee populations. We understand that measuring healthcare trend is critical to understanding a navigation offering’s population-level financial impact on year-over-year claims costs – and having a validated methodology is crucial for employers to trust that our services provide meaningful impact. To demonstrate our confidence in our methodology and ability to positively impact trend for clients, we recently partnered with Avalere Health and the Validation Institute to create a comprehensive validation of our cost savings methodology.

The study we provided Avalere and Validation Institute leveraged consultant benchmarks and data from similar populations to estimate our client's baseline trend expectation as the first step in calculating the healthcare cost savings of our Premium Navigation offering. Our study design controlled for any changes in population age/gender mix, geography, plan design-induced utilization, vendor contracts, and major external events. We then compared the actual trend for populations with access to Premium Navigation versus that baseline expectation.

Based on this study, Avalere and Validation Institute have validated:

- Included Health’s methodology for measuring trend and Premium Navigation’s impact on employer’s healthcare trend

- The methodology supporting the conclusion that Premium Navigation can deliver ~6-10 percentage points lower healthcare cost trend than a comparable national benchmark

- Premium Navigation delivered a statistically significant cost reduction

Premium Navigation can deliver

6-10%

lower healthcare cost trend

Beyond confirming our impact on trend, we believe that it is important to understand the services contributing to this impact. Many navigators claim to reduce trend, but without the ability to attribute results to specific services it is difficult to trust the impact the navigator actually had on trend vs. other factors like clients switching to a TPA or changing plan designs. Therefore, we completed additional analyses to ensure that the clinical measures and book of business cost savings from specific clinical services provided by Premium Navigation are consistent with the validated financial outcomes.

Many navigators claim to reduce trend, but without the ability to attribute results to specific services it is difficult to trust the impact the navigator actually had on trend vs. other factors like clients switching to a TPA or changing plan designs.

Methodology

We partnered with two leading firms to validate our methodology: Avalere and the Validation Institute. Avalere is a data-driven healthcare consulting firm with 21 years of experience. We partnered with Avalere given their deep understanding of healthcare and analytics – including factors impacting healthcare trend – informed by their 230 staff drawn from Fortune 500 healthcare companies, the federal government, top consultancies, and nonprofits. Validation Institute is a professional community that advocates for organizations and approaches that deliver better health value – stronger health outcomes at lower cost. We partnered with Validation Institute given their reputation and credibility in the market based on their experience in evaluating health care offerings.

In our work with Avalere, we asked them to validate trend reduction calculations for employers with Premium Navigation and a retrospective industry estimate of trend from Mercer’s National Survey of Employer Sponsored Health Plans.

The Mercer benchmark is specific to similarly-sized employers, and retrospective, allowing us to compare our results with actual company-reported trend results after accounting for the impact of COVID in the year of study.

The Validation Institute validated our Premium Navigation trend reduction by comparing results from populations with access to Premium Navigation services against nearby populations at the same client with access to a more basic level of Included Health services; this was intended to create a similar comparison that controls for COVID-related impacts on healthcare. Populations were selected for similarity across demographics and plan design, and for populations with any medical or Rx plan changes, the results were analyzed with and without those populations to confirm that any impact caused by plan changes was minimal. In addition, for one client population with significant PBM changes that could have a more profound impact on results, we only measured medical cost allowed amounts and did not include pharmacy costs. Finally, this study also adjusted for risk based on differences in age, sex, and geography in the populations studied.

Both validations studied Included Health clients with Premium Navigation between 2019 and 2020. Both clients had more than 25,000 employees and dependents who gained access to Premium Navigation in 2020. We accounted for the potential impact of COVID in multiple ways. First, we leveraged two methodologies for assessing trend, as described above. Second, we ensured that our product utilization was sufficiently higher than utilization in comparison populations, confirming that our improved results corresponded to changes in service utilization aligned with our interventions.

Financial validation results

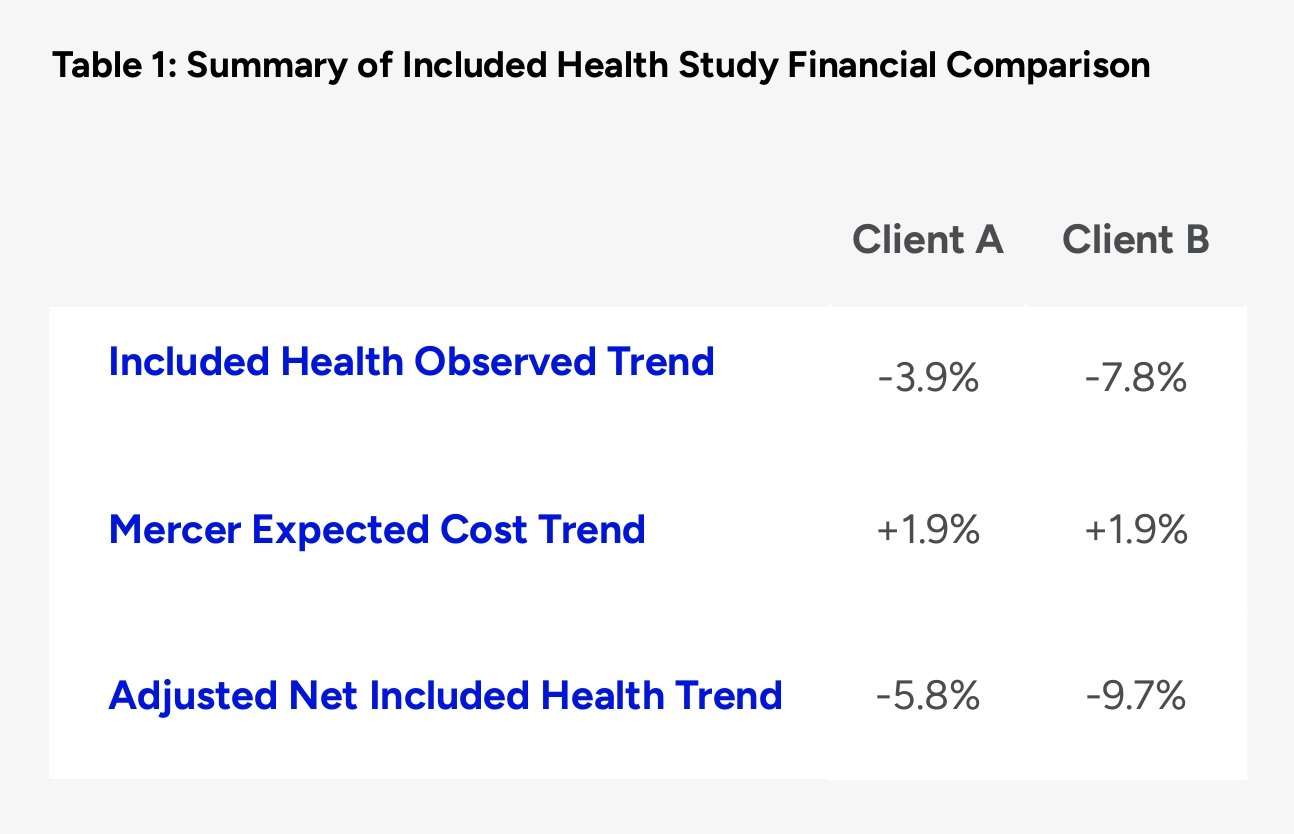

External validation from Avalere confirms the methodology supporting the conclusion that Premium Navigation can deliver ~6–10 percentage point lower healthcare cost trend than a comparable national benchmark. Avalere validated our methodology for measuring trend differences and our claim that Premium Navigation clients saw a measured per member per month (PMPM) cost reduction ranging from -3.9% to -7.8% on a comparative year-over-year basis, and a PMPM cost reduction ranging from -5.8% to -9.7% when compared with a relevant benchmark from Mercer.

Validation Institute has validated Included Health’s methodology for measuring trend, and also validated that Premium Navigation has delivered a statistically significant cost reduction. As a result of undergoing the Validation Institute’s rigorous vetting process, Included Health received the firm’s official "Savings validation,” which is backed by up to a $25,000 guarantee. This validation confirms that Premium Navigation “can reduce health care spending per case/participant or for the plan/purchaser overall.”

Clinically meaningful engagement

Our ability to effectively engage members with relevant clinical services is consistent with the trend reduction results in these studies. The study that Validation Institute and Avalere validated highlighted our ability to effectively engage members with Premium Navigation services, showing:

>80% engagement for members

with >$100K in annual spend and >65% engagement for members with $50-$99K spend, which highlights Premium Navigation’s ability to reach high-need members

>100% year-over-year increase

in new, high-quality PCP relationships among populations in our study with access to Premium Navigation, which highlights our ability to connect members with the right preventive care

>2.5x increase in 2020 member utilization

of Included Health services for populations with access to Premium Navigation vs. the comparison populations, which suggests a correlation between engagement with Premium Navigation and improved trend savings compared with neighboring populations at the clients studied

Unlike other navigation offerings that may skew towards engaging members primarily for basic administrative support, we engaged members with clinically meaningful services.

To further understand Premium Navigation’s ability to drive clinically meaningful engagement, we conducted additional analysis that augments the findings highlighted in the study. This additional analysis showed that we achieved 40-55% household engagement across the two populations included in the study, and among engaged households, about half utilized clinical services.

These clinical services meet a range of needs across the full spectrum of healthcare-related needs. For the general population, our provider matching capability connects members to the highest quality provider for them by taking into account both provider and member attributes, leading to dynamic, personalized matching based on unique member needs. As discussed in the study, this capability led to a >100% increase in new, high-quality PCP relationships among populations in our study with access to Premium Navigation, ensuring that members received the right care.

About half of the engaged households from the populations with access to Premium Navigation in our study utilized clinical services such as expert medical opinions, provider matching, clinical benefits routing, and calls with clinicians.

Looking beyond the study, our provider quality white paper demonstrates how, across our book of business, each connection to a high quality provider drives about $2,100 in savings. That equates to an estimated 33-47% in total savings for each member connected with a high-quality PCP when compared with the 2019 PMPM costs across the two client populations with access to Premium Navigation in our study.

For rising- and high-risk members, our clinical services including expert medical opinions, in-network referrals to high-quality specialists, 24/7 access to clinicians, and care, case, and condition management have also been proven to reduce costs by improving clinical outcomes. For example, based on a savings methodology externally validated by Milliman, our expert medical opinions (EMOs) drive about $9,800 in one-year cost savings by correcting diagnoses or improving treatment pathways. The $9,800 in savings from a single EMO equates to the entire yearly healthcare costs of 1.5 to 2.2 employees based on the PMPM costs of the two client populations with access to Premium Navigation in our study.

This high engagement and the resulting cost savings was enabled by a deep partnership and implementation of best practices to effectively engage members through multiple avenues. Specific drivers of engagement included:

- Leveraging broad outreach opportunities such as open enrollment, placement on the member’s ID card, and placement on the benefits portal to reach members where they spend their time

- Combining clinical insights and data modeling to identify and reach members at the right time, with the right message, such as suggesting our provider matching services to members who recently moved, or our care, case, and condition management services to members who have multiple comorbidities

- Building a tailored, connected experience that guides members to the right benefits based on their preferences and predictive modeling

We are proud of the results we have achieved with our Premium Navigation clients to date, and will continue building on this validation work in the future.