3 health trends shaping financial services benefits

The financial services sector powers the U.S. economy, anchors small towns and major cities across the country, and drives digital transformation and innovation. Its influence and prestige have long attracted ambitious, driven individuals who expect a lot from themselves and their employers.

And yet, when it comes to healthcare, financial services firms are facing the same headwinds as everyone else. Even with the sector's generous compensation and near-universal access to employer-sponsored benefits, benefits leaders struggle to engage employees in their health. They face rising demands around mental health, chronic and complex conditions, and the complexities of managing healthcare for the six-generation workforce.

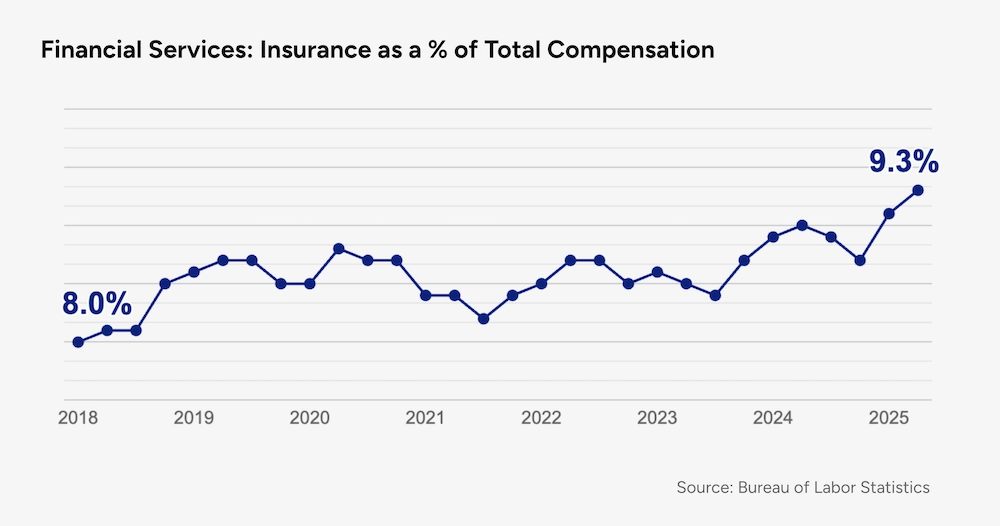

Most importantly, they're also facing escalating costs. Like other sectors, financial services firms are seeing double-digit increases in the healthcare cost trend, and in recent years, insurance — with health benefits by far the biggest line item — has eaten up a growing share of total compensation.

This creates a central challenge for benefits leaders: How do you keep a hard-charging workforce healthy and productive while managing out-of-control costs?

The answer is a forward-thinking benefits strategy that combines flexibility and comprehensive support. That means designing benefits that travel with employees wherever they are — in the office, at home, or on the road — and make it simple to move between virtual and in-person care. And it requires solutions that address the full spectrum of healthcare needs, from primary and preventive care to chronic conditions, mental health, and complex treatments.

Here are three areas where the pressures in financial services are most visible — and where benefits leaders can have the biggest impact.

1. The graying workforce

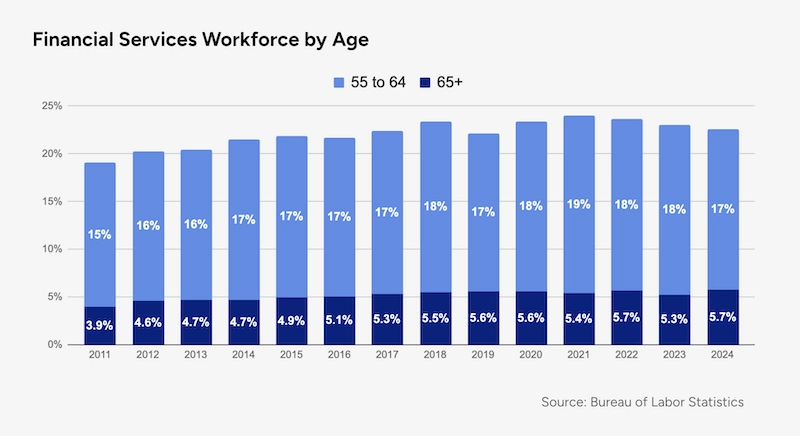

The financial services workforce tends to skew older than other sectors — and that’s more true today than ever. The median age in financial and professional services has been creeping upward; roughly one-quarter of employees are now 55 or older, and nearly 6% are over 65. The AI-driven automation of entry-level jobs could accelerate this demographic shift even further.

An increase of just 1–2% in older workers may sound negligible — but not when you consider that 1% of workers account for 29% of their employer's healthcare costs, according to a recent report from EBRI. This rings true in our experience: At the financial services firms Included Health partners with, the average annual healthcare spend for individuals in this high-need, high-risk category is roughly 6 to 8 times higher than in the general population.

These outsized costs are largely driven by chronic conditions commonly associated with aging (such as heart disease), as well as complex conditions like cancer that are more prevalent in later middle age. Ensuring experienced employees remain healthy and productive often requires providing a different level of support. This can include personalized, high-touch care such as chronic condition management, expert medical opinions, concierge referrals, and help finding high-quality specialists and subspecialists, on top of high-quality primary and preventive care.

Importantly, engaging older employees means using claims and other data to identify both high-cost individuals and those at rising risk of costly conditions. When just a handful of employees can drive a disproportionate share of spend, proactively connecting them with comprehensive support is essential to controlling costs and improving outcomes.

2. Burnout isn't fading away

Greater awareness of burnout in the wake of the pandemic spurred some financial services firms to cap work hours and introduce new well-being policies. But the reception has been mixed. In some high-pressure corners of the field — such as investment banking, securities trading, and private equity — the 80-hour workweek (or 100-hour workweek) is alive and well.

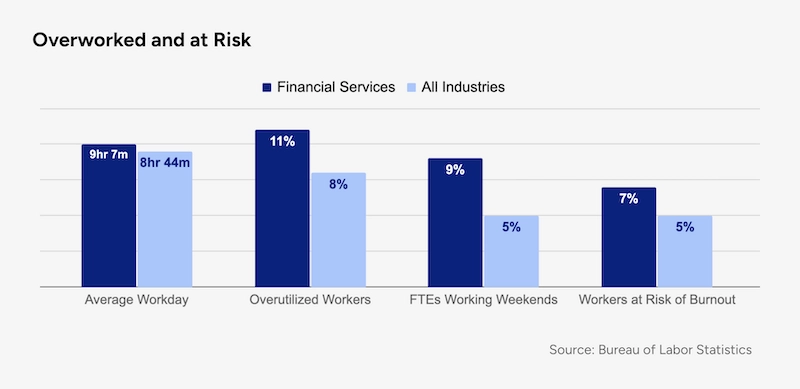

Even beyond those outliers, financial services professionals tend to work longer and harder than their peers in other industries. A 2025 report found that 11% of financial services professionals are "overutilized," and 9% log hours on weekends, double the rate of other sectors. And while overall burnout risk has declined in recent years, 7% of workers remain at risk — the third-highest rate among more than 20 industries surveyed.

For benefits leaders, the concern is not just culture but cost. Burnout takes a toll on both physical and mental health, driving up rates of depression, anxiety, sleep disorders, and even chronic conditions like diabetes. At one large national financial institution we partner with, mental and behavioral disorders alone account for more than $2 million in annual medical spend.

This can become a self-perpetuating cycle, since the long hours and high-pressure environments that fuel burnout can also discourage employees from seeking care. Time-strapped, stressed-out workers are more likely to delay or skip preventive services, missing opportunities for early intervention. This is especially true when it comes to seeking support for mental health, which remains a taboo subject in many financial services workplaces, according to trade group CISI.

As clinicians, we've found that virtual care — and especially virtual primary care integrated with psychiatry and mental health support — can help interrupt this cycle. Integrated virtual care offers ready access to clinicians amid persistent national shortages of primary care providers and mental health professionals. Aside from the access and convenience, virtual care can also help lessen stigma; many employees are more at ease opening up from the privacy of their own home.

The more barriers to care benefits leaders can remove, the less likely "normal" stress and strain will escalate into more serious, costly conditions down the line.

3. Remote work needs flexible healthcare

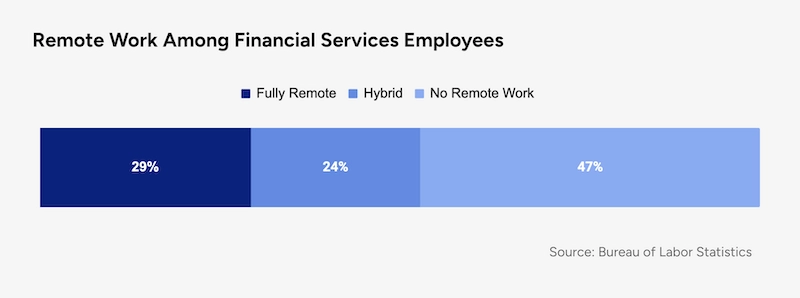

Despite high-profile return-to-office mandates, remote and hybrid work remain common in financial services. The sector shifted dramatically to remote work during the pandemic, and according to the most recent data from the Bureau of Labor Statistics, nearly 30% of financial services employees are fully remote and one-quarter work from home at least some of the time.

For benefits leaders, the staying power of remote and hybrid work underscores the need for healthcare solutions that are both comprehensive and flexible. Office-based employees may find it harder to fit a 9-to-5 doctor's office visit into their schedule, increasing the likelihood of delaying essential care.

Health benefits need to keep up with evolving patterns in remote work. Just as employees expect greater flexibility in where and when they work, they also expect to access high-quality care from anywhere, on their schedule. Not surprisingly, this is especially true for caregivers, who value work-life balance and workplace flexibility even more than other workers.

Here again, virtual-first care is an important lever, and a clear example of how access and convenience can improve outcomes and lower costs. At the financial services firms Included Health partners with, nearly half of people who complete a virtual primary care visit say they would have gone to urgent care or the ER instead — a stressful and potentially costly outcome for employee and employer alike. By providing a more convenient and appropriate path to care, employers can avoid significant, unnecessary costs for both themselves and their employees.

Turning headwinds into momentum

For benefits leaders in financial services, the challenges are undeniable — but so is the opportunity. Rising costs, burnout, remote work, and an aging workforce don’t have to be roadblocks.

A benefits strategy that combines virtual-first care and comprehensive support can help employees find care more easily, make better choices, and stay healthier over time. Just as important, it shows employees that their employer understands the pressures they face and is investing in solutions that fit the way they work and live today.

By leaning into innovation and engagement, benefits leaders can turn headwinds into momentum — creating healthier employees, stronger organizations, and a more resilient workforce for the future.

About the authors

Phil Zuzolo, MD

Dr. Phil Zuzolo is a general practice physician focused on using technology to improve access to high-quality care. As Director of Clinical Operations, he leads Included Health clinical teams and is responsible for ensuring that our members receive the best possible medical care.

Connor Lundy, MD

Dr. Connor Lundy is a board-certified Emergency Medicine physician and healthcare leader with over 15 years of clinical practice and administrative expertise. As an Associate Medical Director at Included Health, Dr. Lundy leverages his extensive experience to advance population health initiatives, enhance access to convenient and preventive care services, and drive healthcare quality improvement.