As Healthcare Costs Soar, Employers Need to Double Down on Value

The cost of healthcare is threatening businesses and households nationwide. Employers expect costs to increase by 9% this year. Many are reluctantly passing some of those costs onto employees, who have seen their out-of-pocket healthcare expenses rise even faster than overall inflation. Last year, Americans borrowed $74 billion to cover medical bills.

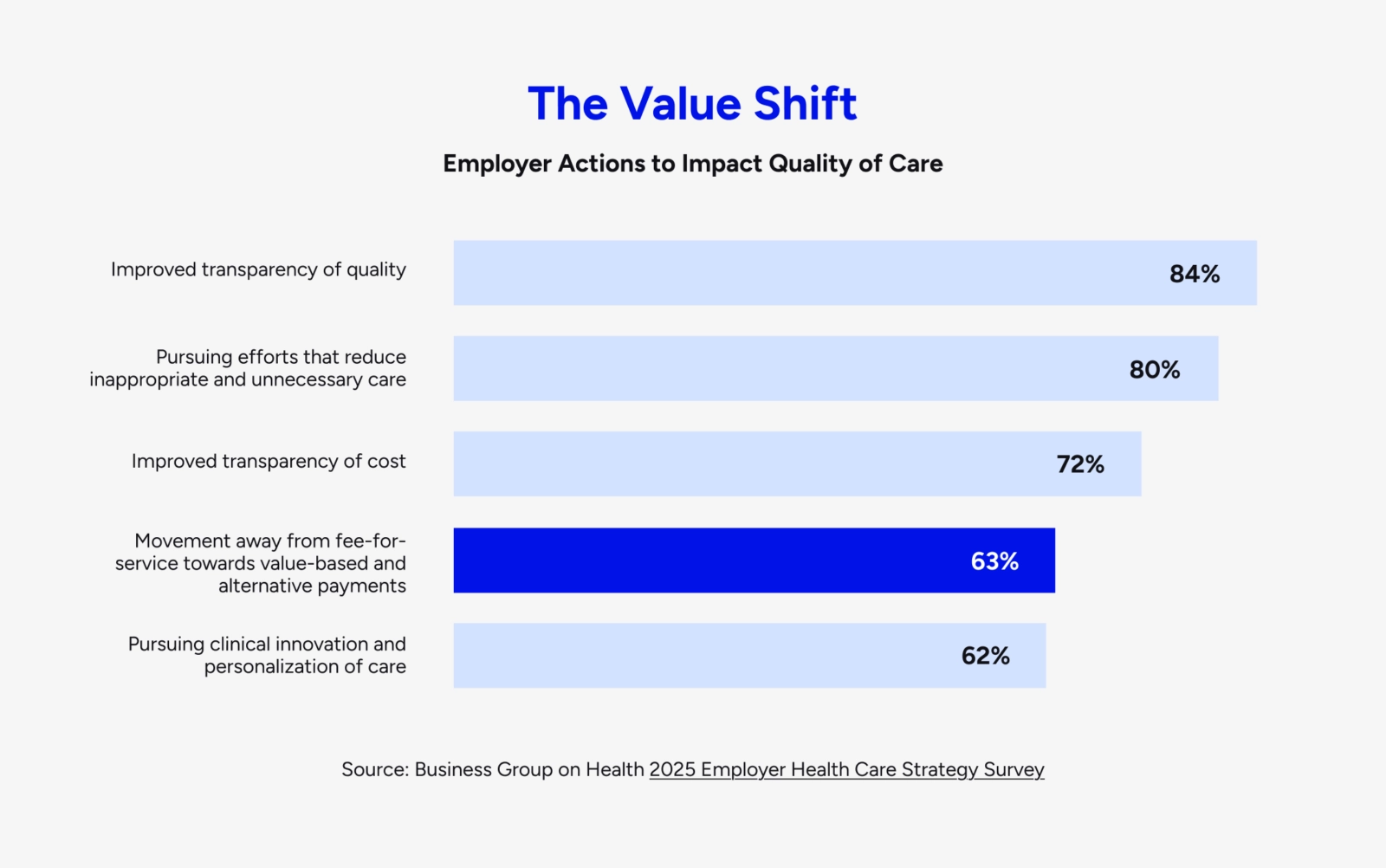

This cost crisis is leading employers to sharpen their focus on value: the tangible outcomes they, and their workers, are getting for their healthcare dollars. In an offshoot of value-based care, nearly two-thirds of large employers are pursuing value-based benefit strategies in which their healthcare spend is explicitly tied to outcomes and quality, rather than the volume of services provided.

This pivot from volume to value is long overdue among the employers that provide health insurance to 160 million Americans. While value-based payment models have become the norm in Medicare, fee-for-service still dominates the group commercial insurance market. Value-based arrangements have largely been limited to carve-out solutions for certain conditions or clinical needs.

While some (not all) of these pinpoint solutions do deliver lower costs and better outcomes, clearly it hasn't been enough to reverse the macro trend. Reining in costs, without cutting corners on workers' health, will require a bigger commitment and a more comprehensive, dynamic approach — from employers and their healthcare partners — specifically aimed at lowering the total cost of care.

Large employers and public-sector organizations with a long track record of healthcare innovation, such as Walmart and the California Public Employees' Retirement System (CalPERS), are leading the way here. As CEO of Included Health, I've been fortunate to partner with both as they lean into value.

Last year, Walmart rolled out zero-copay virtual primary care to more than 1 million of their associates, after a rigorous three-year study found that it reduced the total cost of care by 11%.

CalPERS, in a first-of-its-kind partnership that went live in January, has aligned incentives among health plans (Blue Shield of California) and healthcare partners (us) by tying fees to the overall cost trend; we get paid based on how much we bend the curve.

We need more of this in healthcare. More experimentation, accountability, and in-it-together risk and reward designed to make people and businesses healthier

Innovation at Work: CalPERS

In 2024, CalPERS awarded five-year contracts to Included Health and Blue Shield California to provide integrated care, navigation services, and advocacy support. Included Health and Blue Shield have committed to a medical trend cost target. If they fail to meet the target, the two partners are collectively putting $464 million in fees at risk. If they beat the target, however, they stand to share in the savings.

Benefits and finance leaders may argue that Walmart (the largest private employer in the U.S.) and CalPERS (the nation's second-largest healthcare purchaser, after the federal government) are outliers, not realistic role models. Very few organizations are in the same orbit, it's true, but the idea that value-based partnerships are feasible only with massive scale and purchasing power is outdated.

Innovators like Walmart and CalPERS have taken on the hard work and risk of designing the recipe and testing what works, and smaller organizations are now in position to benefit from their example and apply their learnings and results to their own populations.

Healthcare value is more accessible than ever. Advances in technology, combined with new players and partnership models, are enabling more organizations to unlock the clinical and financial outcomes necessary to reverse the long-term cost trend. Scale still helps, but the keys to value — personalization, integration, and a better experience — are well within reach for a growing share of the commercial market.

1. Personalization

Value-based care in the Medicare market has, ironically, mostly been a volume play. The healthcare needs associated with aging are prevalent and predictable at the population level, and even modest efficiencies and quality improvements — limiting unnecessary tests and procedures, for example — can generate significant cost savings.

The workforce is a different story. Roughly three-quarters of healthcare costs are driven by just 10% of employees — and it's not obvious which 10% will get a cancer diagnosis or a debilitating back injury. In this population, lowering the total cost of care requires identifying at-risk workers and anticipating the care that's best for them, through real-time intelligence, proactive engagement, and tailored care pathways that combine population-level insights with individual needs and preferences.

AI has made this combination of big data and personalization a reality. For more than a decade, healthcare innovators have been pairing machine learning with human clinical expertise to optimize care for both people and populations. (At Included Health, our personalized physician recommendations are built on more than 300 separate proprietary models.) Now, thanks to the revolution in generative AI, we also have a growing arsenal of virtual assistants and engagement tools that are making healthcare easier, more efficient, and more personal for patients and doctors.

In Medicare, you can get to value by focusing on the haystack. In the commercial market, you have to find, engage, and take care of the needles, and AI — with the right humans at the wheel — is powering that fine-tuned approach at scale.

2. Integration

Many traditional value-based care models (such as patient-centered medical homes) share some core principles: better access to primary and preventive care, a whole-person approach spanning physical and mental health, a focus on care coordination and patient-provider relationships.

This type of holistic, integrated care has been shown to produce better outcomes at lower cost, but in the past — just like personalization — it hasn't been workable at scale. In conventional healthcare settings, attempts to bring the necessary services under one roof have run into predictable barriers, including staffing challenges, infrastructure and technology limitations, and siloed data and workflows that hinder provider collaboration.

Here again, technology and new care delivery models are removing long-standing barriers. Integrated virtual-first care — including virtual primary care, specialty care, and mental health support, with referrals to in-person care when needed — has improved access and connections across all healthcare settings, closing costly gaps in care. (In the Walmart study, to cite one example, 37% of people who accessed virtual primary care went on to see a therapist or psychiatrist.)

Just as important, the technology behind the scenes is connecting previously siloed data sources — medical and pharmacy claims, cost and quality metrics, and social and demographic info — to surface insights for clinicians and care teams, enabling better communication and collaboration in the service of whole-person health.

We've known for a long time that addressing the full range of healthcare needs in one place unlocks value; we just weren’t able to build that place with bricks and mortar alone.

3. Better experience

By itself, integrated care delivery isn't enough. While critically important, the time that doctors and patients spend together is a fraction of the overall healthcare experience, and just one part of the healthcare value equation. Comprehensive wraparound services, ranging from case management to claims advocacy, are equally important to ensure that employees understand their benefits and coverage, get to the right care at the right time, and stay engaged between visits.

Providing this all-in-one experience — spanning care delivery, financial, and administrative needs — is essential to improving clinical and financial outcomes. It seems simple, and is available in so many other industries, yet it remains the exception in healthcare. Why?

The simple answer is the silos and incumbents that have dominated the landscape for the past 50 years. As purchasers of healthcare, employers and employees have been stuck in the middle of two imposing and opposed forces — healthcare providers on the one hand, and insurers on the other. Historically, with good intention, providers have pushed to deliver more care without consideration of cost, and insurers (not surprisingly) have resisted it, often by throwing up access and administrative barriers.

Healthcare — including our understanding of value — has been defined by this tug-of-war. Restoring value in the commercial market means rethinking the traditional provider-insurer paradigm and, as CalPERS has, engaging like-minded partners to rebuild the healthcare experience from the ground up, with people at the center. Personalization and integration create a better experience, which builds trust, drives ongoing engagement, and delivers outcomes that matter to people and purchasers — this is the virtuous cycle that creates value.

Organizations and workers: allies in value

This blueprint is achievable at an unprecedented scale. The commercial market can't afford to say no to it, and neither can the workforce. In this case, in fact, employers and their employees are natural allies. While they don’t always see eye to eye, especially when it comes to benefits and premiums, they are both in the same leaky and very expensive healthcare boat.

Value for employees and value for employers goes hand in hand. Workers and their families want to be healthy and holistically cared for — mind, body, and wallet. In turn, healthier workers bring costs down for their employers, and they generate a host of positive knock-on effects that bolster the bottom line, including higher productivity, engagement, resilience, and retention.

Traditional value-based care was designed for a different market and a different era. It’s early days, but organizations like Walmart and CalPERS are showing there’s another path to value in both the public and private sector. For costs to come down, others need to get on board.

Owen Tripp, CEO and Co-Founder

About the author

Owen Tripp is the CEO and cofounder of Included Health, a new kind of healthcare company delivering personalized all-in-one healthcare to millions of people nationwide.