Access your

healthcare account

Discover all your benefits.

Some services may be limited based on your medical enrollment.

Covered visits for Syniverse team members

Urgent Care, Behavioral Health, and Virtual Primary Care

Syniverse medically enrolled employees and dependents have access to Doctor On Demand’s Virtual Primary Care inclusive of a dedicated primary care physician, integrated behavioral health, 24/7 urgent care, and Care Team support with awesome benefits like dieticians and more all available right from your smartphone, tablet, or computer.

Syniverse non-medically enrolled employees will have access to urgent care and behavioral health visits only.

Included Health is available to employees and dependents who are enrolled in a Syniverse medical plan. Syniverse provides this service so that you have access to the best medical care possible.

CDHP Value plan members pay $20 after deductible is met.

Virtual Primary Care Frequently Asked Questions

Virtual Primary Care by Doctor On Demand

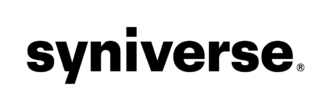

Get care, anywhere.

It's easy. To get started, download the app.

- 1.Activate your account

- 2.Search for the care you need

- 3.Get matched with high quality care

How Included Health helps

Navigate health care easily. Watch our video to learn more about how Included Health can help you and your family.

Enroll in the Connected Care Program

Whether it's for a pregnancy, acute pain, chronic conditions such as diabetes, high blood pressure, asthma, or more. This program offers access to a team of doctors to design a care plan that's right for your needs.

Call 1-855-429-7114 and ask if you are eligible for the connected care program.