Access your

healthcare account

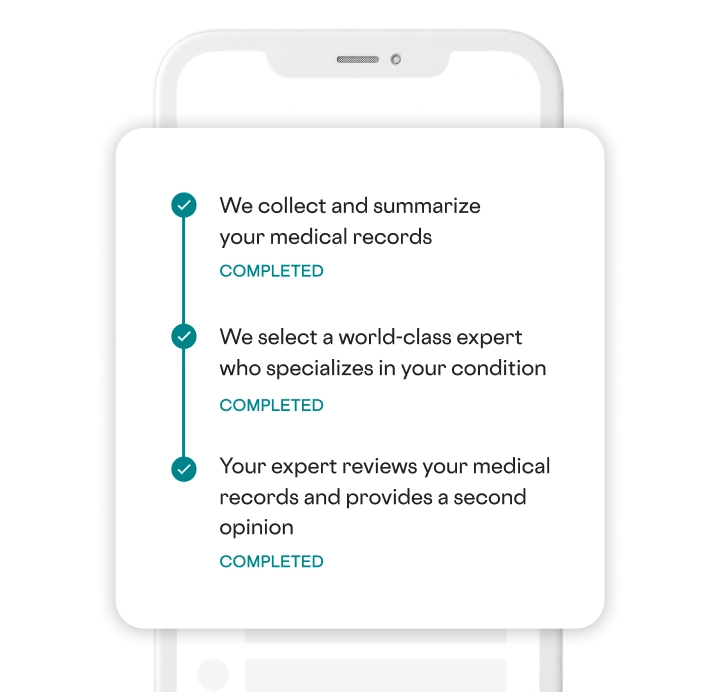

No need for extra exams or appointments. Included Health gathers your records, finds the right specialist to review your case, and stays with you through every step of the process–at no cost to you and your covered dependents.

Discover all your benefits

Lennox and Included Health have teamed up to support you and your family’s overall health at no cost to you.

What a second opinion can help with:

- Cancer

- Diabetes

- Joints and muscles

- Back and knee pain

- Fertility conditions

- Long covid

- Heart issues

- Migraines

- Alternatives to surgery

- Medication options

- Weight Management

- Mole and skin growths

- Depression and anxiety

- And more

Curious about a second opinion?

Watch our video to learn how easy it is to get an expert second opinion with Included Health. Your care team does the hard work for you, so you can focus on feeling better.

Get the best care from the best doctors.

Do it all from the

Included Health app.

Frequently asked questions

Common questions about our health benefit

Virtual primary care frequently asked questions

Virtual Primary Care by Doctor On Demand