Welcome to your Apogee Enterprises, Inc. benefit

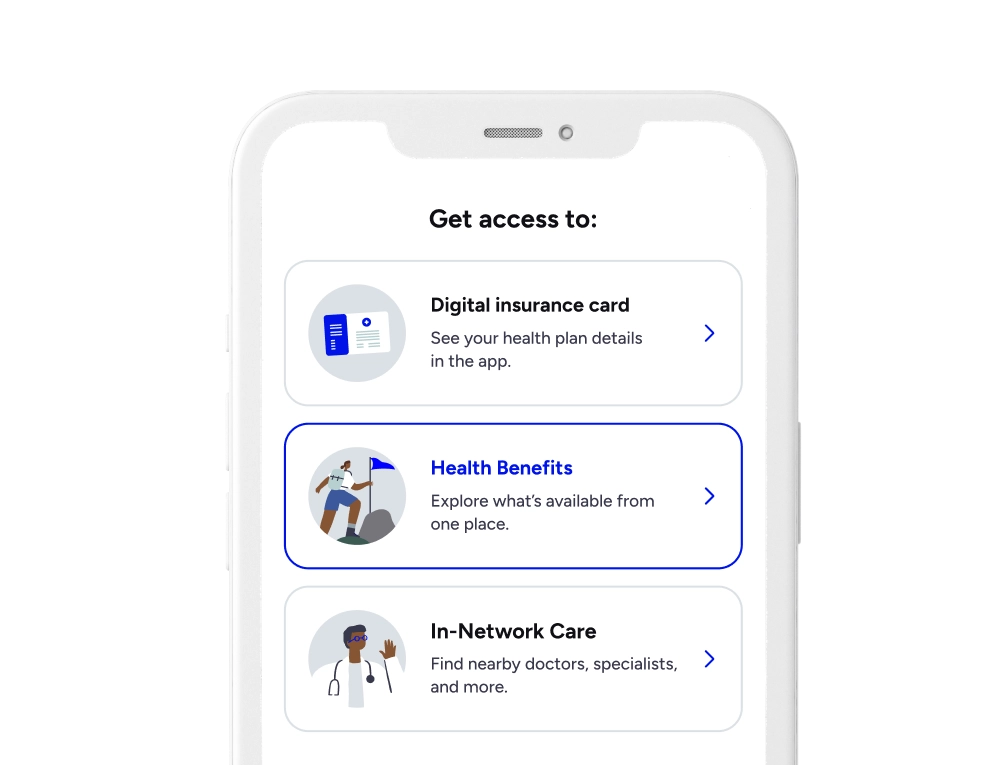

Access your

healthcare account

Discover all your benefits.

We’re helping almost six million people live their healthiest lives.

Included Health has helped me navigate my way through the healthcare system. I finally had somebody that was going to be in my corner and find me what I needed.”

—Robert, Included Health member

Common questions about Included Health

Download the

Included Health app

Try the app, it’s easy. We just need to check a few details.

- 1.Activate your account

- 2.Search for the care you need

- 3.Get matched with high quality care

Download the Included Health app.

Download the Included Health app.