Activate for a better healthcare experience

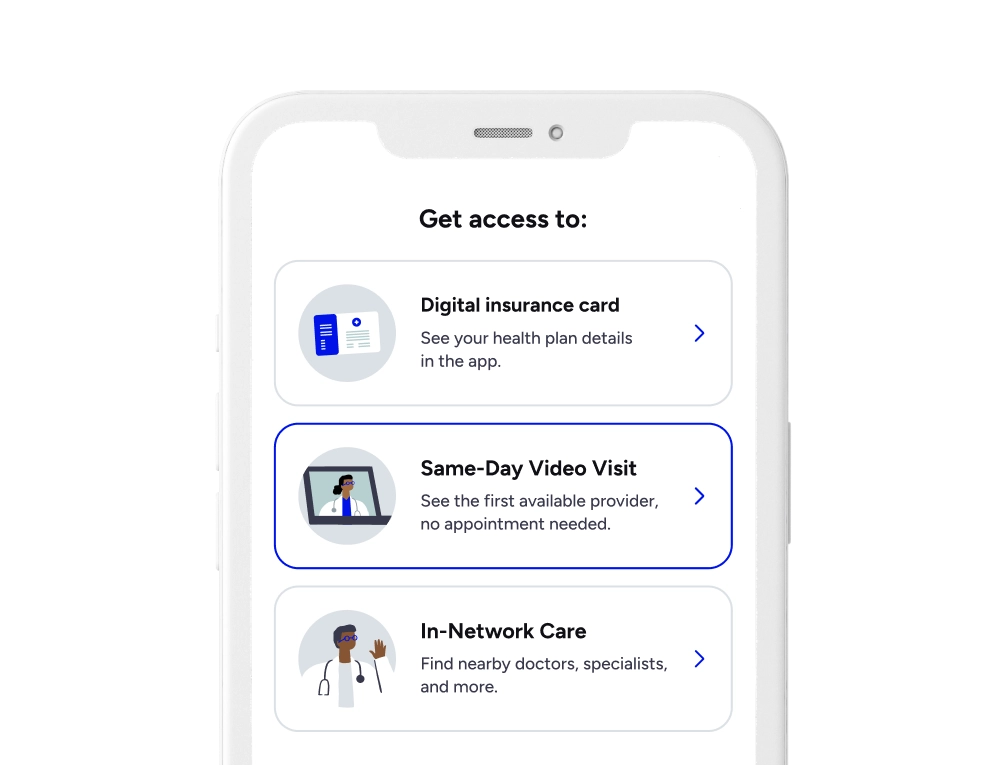

Discover all your benefits.

Covered visits for Amedisys members

You have access to Urgent Care + Behavioral Health online appointments. Urgent Care is available within minutes, behavioral health appointments average a few days—but patients can use urgent care for urgent mental health issues and get a referral within the app to behavioral health.

Copays varies by plan.

Copays varies by plan.

Get care, anywhere.

It's easy. To get started, download the app.

- 1.Activate your account

- 2.Search for the care you need

- 3.Get matched with high quality care

How Included Health helps

Navigate health care easily. Watch our video to learn more about how Included Health can help you and your family.

Get personalized care for chronic conditions, pregnancy, and more at no cost to you.

With Care Management, get a dedicated team of doctors, specialists, and care coordinators for 24/7 support. Your team works with you to create a care plan personalized to your needs.

Find out if you're eligible fast by calling 1-855-429-7330.