The latest trend in workforce well-being? Value-based care

Employers and workers don't always see eye to eye, but this year they agree on at least one thing: The economy is stressing everybody out.

Businesses and households are both feeling the pinch of higher prices. Businesses are forecasting slower growth and hiring amid a cloudy outlook, while employees are worried about the impact of a possible economic downturn on their job security and prospects. Workplace mental health concerns are on the rise.

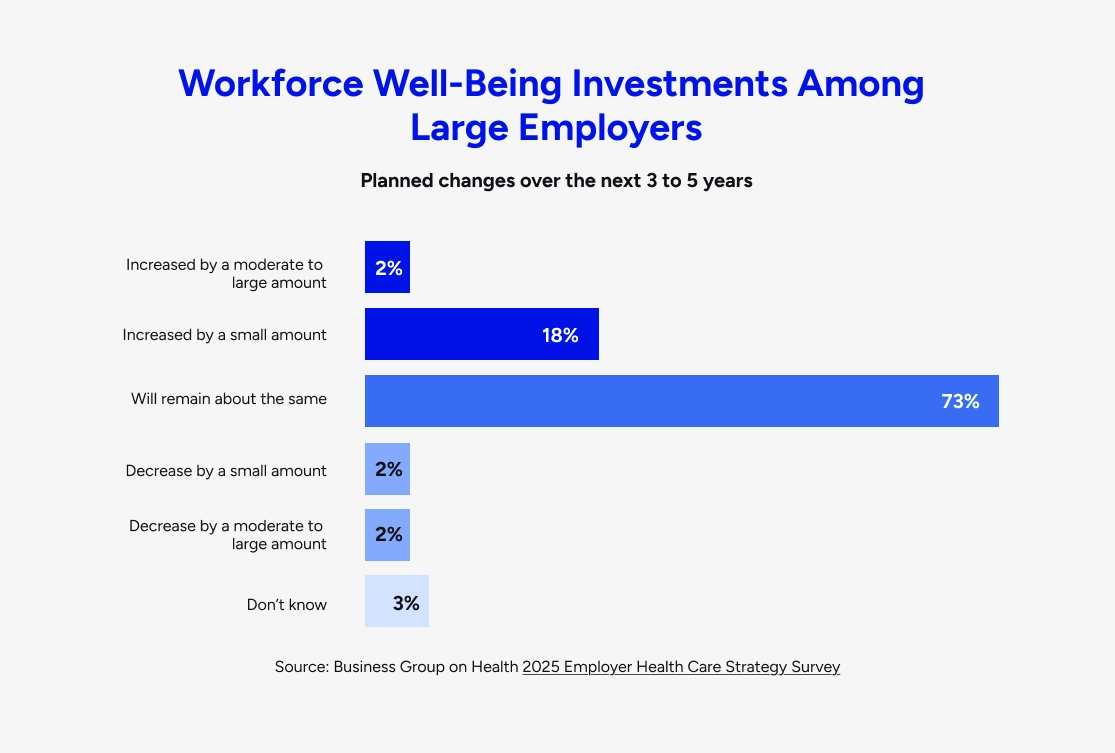

Now for the good news: Despite the uncertain macro environment, employers are doubling down on workforce well-being. With healthcare costs rising even faster than inflation, one might expect businesses to pull back on health benefits and services, but in fact, they're doing the exact opposite.

According to an annual survey from the Business Group on Health, more than 90% of large employers are extending or expanding their investment in employee health and well-being solutions over the next 3 to 5 years. Beyond that, roughly half of senior executives and benefits leaders identify well-being as "integral" to their workforce strategy and business success.

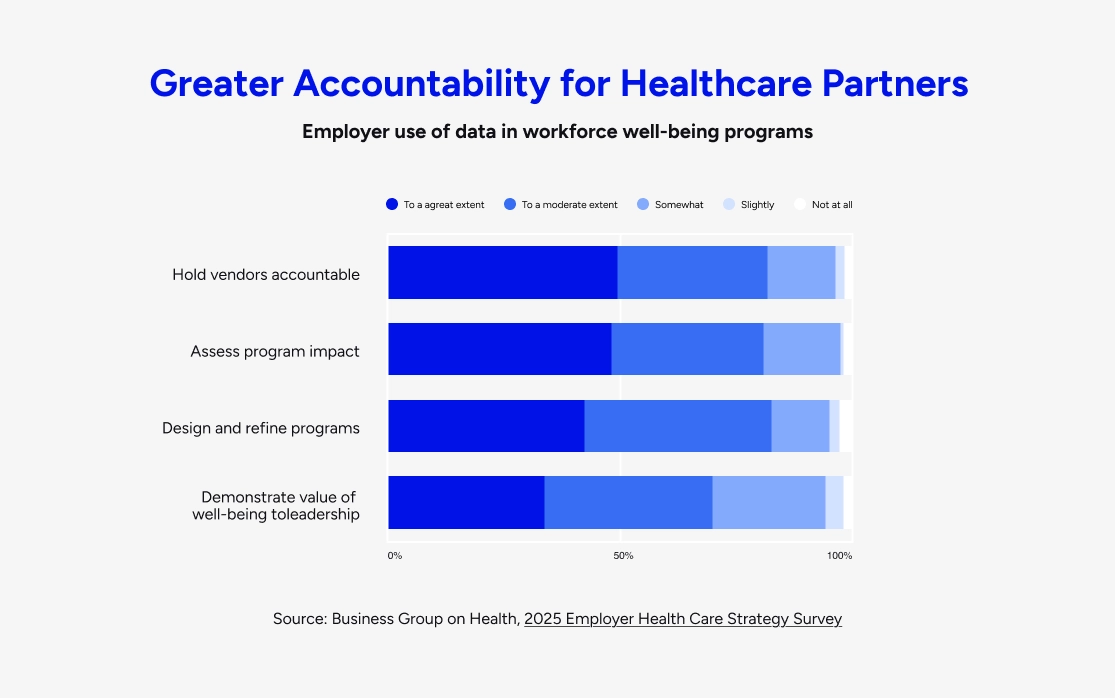

There is a catch, though. An overwhelming majority of employers also said they are increasingly tying their investments to measurable outcomes, and in turn are demanding more accountability from their healthcare partners. Specifically, they're seeking hard data that shows the benefits they offer are actually moving the needle on two main objectives: making people healthier and reducing costs.

Accountability for improving health outcomes while lowering costs — there's a name for this: value-based care. Though the label has been applied to a wide variety of flavors and models, the core idea behind value-based care is paying healthcare providers based on quality and outcomes, rather than on the volume of services.

Though it's far less prevalent in the commercial insurance market than in government-funded healthcare (and Medicare, especially), value-based care isn't a totally new concept in the employer benefits space. Employers have long used value-oriented strategies in their contracting and benefits design. Many, for example, already require guarantees from their partners tied to service responsiveness or performance, quality measures, health trends (such as demonstrated improvement on depression scores), or even ROI.

Spurred by skyrocketing healthcare costs, though, innovative benefits and finance leaders are looking beyond these established models and pushing their partners to make their investments work even harder — not only for employees and their dependents, but for more favorable impact on the broader business.

National employers like Walmart, as well as public pension funds and other large public-sector organizations, are leading the way in this area — and more specifically, in reducing overall healthcare spend.

This year, for instance, the California Public Employees' Retirement System (CalPERS) launched a unique partnership with Blue Shield California and Included Health to provide personalized health care and navigation services to 250,000 CalPERS members. The partnership ties payment to various clinical quality measures, as well as to CalPERS' overall healthcare cost trend. If Blue Shield and Included Health fail to deliver on our targets, we forfeit a portion of our fees — and if we exceed them, we also share in the savings.

This level of accountability and aligned incentives is the wave of the future in the private sector, and the surest way to deliver outcomes that matter to employees as well as employers. While they might not know to ask for it by name, value-based care provides business leaders the assurance they need that their benefits are taking care of their workforce and the bottom line.

Robin Glass, President

About the author

Robin Glass leads the growth & business excellence organization, where she is responsible for ensuring our products deliver value to our clients. She has over 20 years of experience building and scaling growth organizations for innovative healthcare companies. Prior, she was Chief Customer Officer at Evolent Health, a publicly-traded value-based care company. Robin has a BA in Public Policy from Duke University and an MBA and Masters in Public Administration from Harvard University. She lives in the San Francisco Bay Area with her husband and three daughters.